Warning Investors Capital Focus (clone)

Regarding market intermediaries (investment and trading advisers, collective investment schemes, brokers, dealers, and transfer agents)

Introduction:

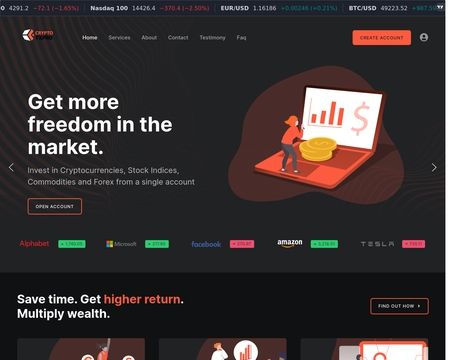

In the vast landscape of investment opportunities, it’s crucial to be discerning and cautious, as not all companies have your best interests at heart. Capital Focus (Clone) is one such entity that should be kept at arm’s length. This article delves into the murky waters of this suspicious operation, highlighting the numerous red flags that should deter any prudent investor.

Regulation and Compliance:

When it comes to safeguarding your investments, regulation and compliance are paramount. Unfortunately, Capital Focus (Clone) fails miserably in this aspect. The company is not regulated by any credible financial authority, including the Dutch Authority for the Financial Markets (AFM). It lacks the necessary licenses or a European Passport, which is a clear indication that it is unauthorized to offer investment services in the Netherlands or the European Union. Moreover, it’s not affiliated with any reputable regulatory body or trade association, leaving investors with little to no recourse in case of foul play.

Reputation:

The reputation of any investment firm can speak volumes about its integrity. In the case of Capital Focus (Clone), the silence is deafening. A quick online search reveals a litany of complaints and accusations of fraud and deceit from individuals who have had unfortunate encounters with this company. The warning signs are too numerous to ignore.

Customer Support and Customer Reviews:

Customer feedback is often a reliable barometer of a company’s trustworthiness. In the case of Capital Focus (Clone), the absence of positive reviews is glaring. Instead, it’s overshadowed by a multitude of distressing customer experiences. These include unsolicited phone calls and emails offering too-good-to-be-true investment opportunities. The company employs high-pressure sales tactics and aggressive persuasion to extract funds, often directing them to foreign bank accounts.

Transparency is a foreign concept to Capital Focus (Clone), as they withhold critical information about their background, credentials, fees, risks, and terms and conditions. Furthermore, they are either unwilling or unable to provide proof of identity, registration, licensing, or authorization. Once you invest, contacting the company becomes a near-impossible task, and withdrawing your money is equally elusive.

Products and Services:

Capital Focus (Clone) claims to offer a wide array of investment products and services, including stocks, bonds, commodities, currencies, options, futures, and derivatives. However, don’t be fooled by these claims. The reality is that these products and services are either nonexistent or utterly worthless. The company lacks access to legitimate markets or platforms for executing trades, and it has no discernible expertise or experience in the financial sector. In essence, the company’s sole purpose is to fleece investors of their hard-earned money and vanish into the shadows.

Location:

While Capital Focus (Clone) claims to be headquartered in Amsterdam, the Netherlands, this is nothing more than a deceptive ruse. The address, website, phone number, and email are all fabricated and untraceable. This company operates from offshore locations, well beyond the reach of Dutch authorities, making it incredibly challenging to hold them accountable.

Customer Service:

In the world of legitimate investment firms, customer service plays a pivotal role in providing support and assistance to investors. However, Capital Focus (Clone) operates in the shadows and offers no customer service or support. Once your funds are transferred, the company becomes a ghost, leaving investors high and dry. Their website, phone number, and email address are either disconnected or deliberately ignored. It’s impossible to find a physical office or representative to contact or visit.

Conclusion:

In conclusion, Capital Focus (Clone) should be unequivocally avoided. This is not a legitimate investment firm but a perilous scam that preys on unsuspecting investors. It is devoid of regulation, reputation, products, services, location, and customer service. The only currency it deals in is deception, and its only objective is theft. If you’ve been contacted by Capital Focus (Clone), it’s imperative to disengage and refrain from sharing any personal or financial information. If you’ve already invested, report them to the AFM and consult legal advice immediately. Your financial security depends on it.