What Are Crypto Exchanges?

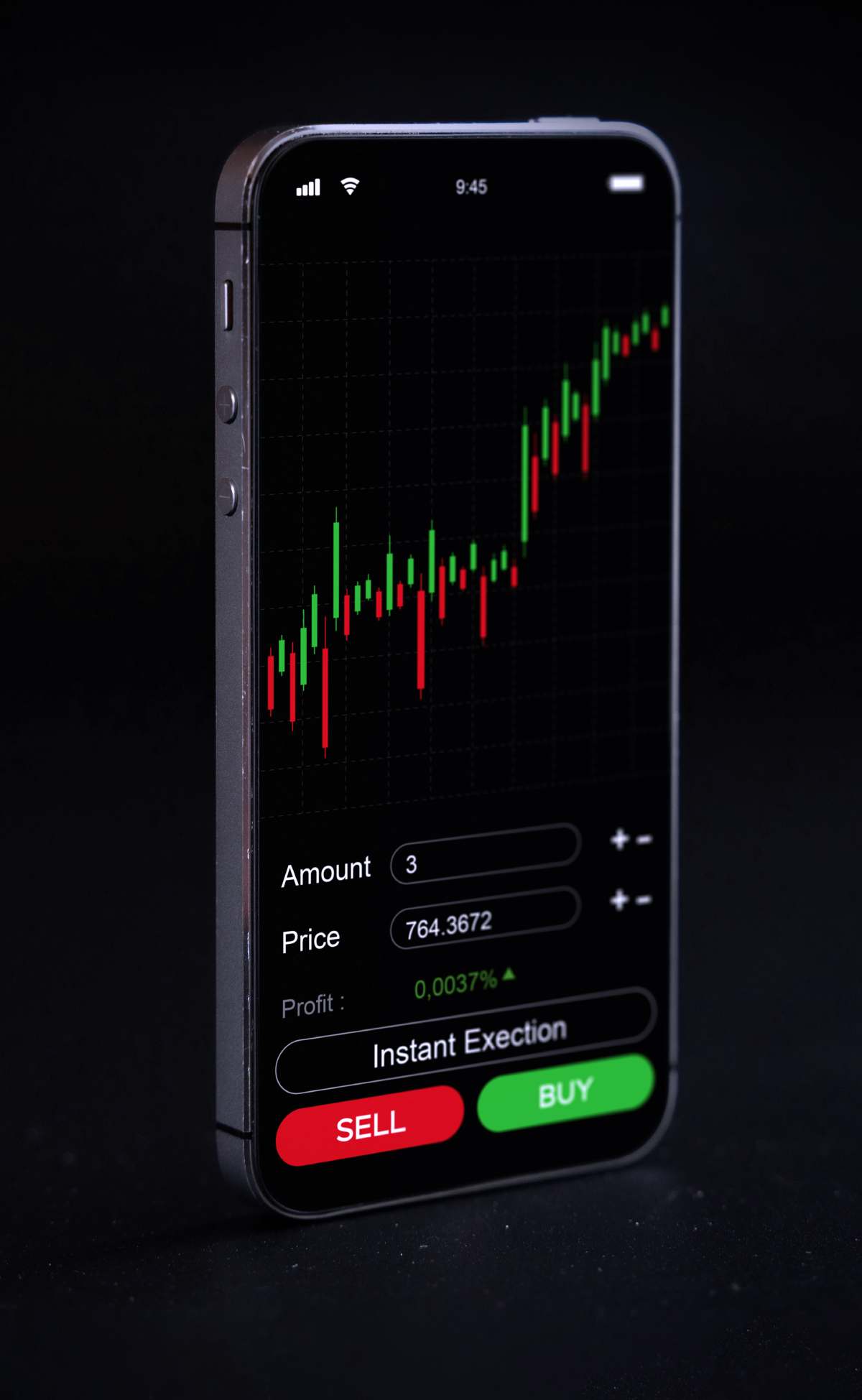

Crypto exchanges are a place you can buy or sell or trade cryptocurrencies. They also provide various other crypto services, such as bitcoin mining. Before exchanges and platforms, crypto users could only obtain cryptocurrency through transactions with individuals or mining cryptocurrencies.

Since the advent of bitcoin in 2009, hundreds of crypto platforms and exchanges have sprung up. Many provide a necessary resource for crypto users and have made it easier to benefit from crypto assets.

However, the darker side to this development is that the number of fraudulent crypto exchanges and platforms has skyrocketed. This has led to an increase in financial crimes. Also, even licensed platforms have been hit with cybercrime and have had to deal with the challenge of keeping their customers safe from crypto fraud.

What Types of Crypto Exchanges Are There?

- Crypto Brokers

- Centralized Crypto Exchanges

- De-Centralized Crypto Exchanges

Whether you want to trade cryptocurrencies or use your cryptocurrency to trade other assets, seek out the services of a licensed and reliable crypto broker. A broker trades on behalf of clients. It’s important to always trade with a licensed broker that has a record of success.

Centralized crypto exchanges allow you to make cryptocurrency transactions and execute your own trades. They often offer additional crypto services. All of the activities on the exchange are overseen by an authority. Many people feel more secure working with a centralized crypto exchange because there is an authority to appeal to if something goes wrong.

For full autonomy, many people choose decentralized crypto exchanges. These offer many of the same services as centralized platforms, except that there is no centralized authority. Instead, decentralized exchanges use peer-to-peer funding. The drawback to decentralized platforms is it’s difficult to resolve disputes without a third party or authority to provide oversight.

Whether you want to trade cryptocurrencies or use your cryptocurrency to trade other assets, seek out the services of a licensed and reliable crypto broker. A broker trades on behalf of clients. It’s important to always trade with a licensed broker that has a record of success.

Centralized crypto exchanges allow you to make cryptocurrency transactions and execute your own trades. They often offer additional crypto services. All of the activities on the exchange are overseen by an authority. Many people feel more secure working with a centralized crypto exchange because there is an authority to appeal to if something goes wrong.

For full autonomy, many people choose decentralized crypto exchanges. These offer many of the same services as centralized platforms, except that there is no centralized authority. Instead, decentralized exchanges use peer-to-peer funding. The drawback to decentralized platforms is it’s difficult to resolve disputes without a third party or authority to provide oversight.

Look for the Following When Choosing a Crypto Exchang

- License

- Fee structure

- Security

- Deposits and withdrawals

- Reputation

- Customer service

- Transparency

It’s a myth that crypto platforms and exchanges don’t need a license. All financial companies or brokers need to be regulated and authorized to trade money on behalf of others by a regulatory agency. This is something universally agreed upon by the worlds leading financial regulators. Check for a license and validate the information is correct.

Find out what fees the crypto exchanges are charging and check that they are consistent with the industry standards. Also, ensure that security is of the highest standard. Don’t get lured into a false sense of security because you know that the blockchain is encoded with encryption. A crypto exchange still needs a high level of cybersecurity protection.

Make sure you can gain access to your funds when you need them. The last thing you should deal with are flimsy excuses why the exchange won’t allow access to your funds. Check the requirements for deposits and withdrawals and avoid exchanges that have a lot of strange rules about withdrawals.

Look for media mentions and independent reviews. These can tell you much more about a crypto exchange than customer reviews. Find out what the experts have to say about which crypto platforms are the best.

Check out customer service. Ask them a question and see if they are attentive and helpful. Also, know who you’re trusting your money with. Find names, bios, contact information, and credentials of the people who run the crypto exchange. If you can’t find this information, avoid signing up with the exchange.

Have You Lost Money on a Crypto Exchange? Talk to CryptoCoinTrace Experts

Our team of crypto experts uses proprietary methods, specialized crypto trace software, and customized investigation strategies and makes them work for you. We give our clients the tools to approach law enforcement and crypto exchanges so they will act on your claim. The sooner talk to us, the greater the chances of a successful claim!