Warning Investors BitSoft360 and BitSoftAI360 – they’re ticking all the boxes for a classic online scam with their lack of regulation, negative customer reviews, dubious claims, undisclosed location, and abysmal customer service.

Introduction:

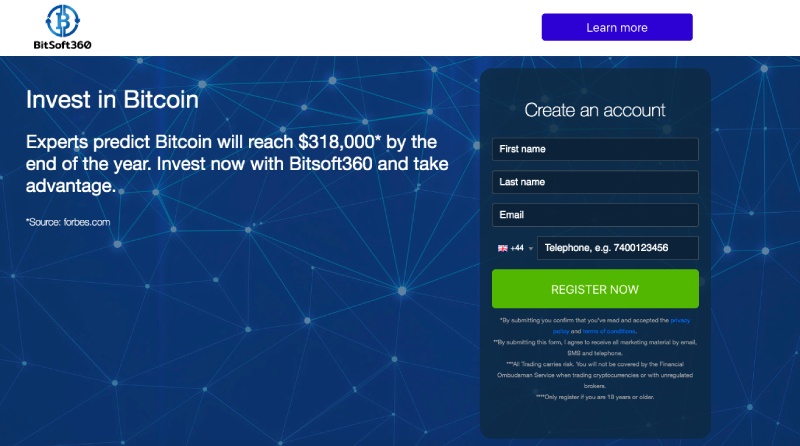

Enter the ominous world of BitSoft360 and BitSoftAI360, two online platforms claiming to revolutionize trading and investment through the magic of artificial intelligence. Before you get lured in by promises of high returns and low risks, it’s crucial to heed the warning signs that suggest these platforms might be nothing more than a classic online scam.

Regulation and Compliance:

The first and most glaring red flag in the BitSoft360 and BitSoftAI360 saga is their lack of regulation and compliance. These platforms operate in the shadows, not bothering to register or gain authorization from any financial regulator in any jurisdiction. The Manitoba Securities Commission (MSC) even issued a stern warning on November 8, 2023, cautioning potential investors about the fraudulent activities of these platforms. To add weight to the alert, the MSC provided a link to detailed press releases on its website, highlighting the seriousness of the issue.

Customer Support and Customer Reviews:

Another area where BitSoft360 and BitSoftAI360 stumble is in the realm of customer support and reviews. A quick online search reveals a scarcity of reviews, and the few available are overwhelmingly negative or dubious. Unhappy customers have reported financial losses, difficulties withdrawing funds, and a general lack of transparency from the platforms. Some reviews even raise suspicions of fake or paid endorsements, with generic language and a conspicuous absence of verifiable details.

Products and Services:

BitSoft360 and BitSoftAI360 boast an extensive list of products and services, ranging from forex and cryptocurrency trading to stocks, commodities, indices, ETFs, bonds, and options trading. However, these grand claims lack substance. The platforms fail to provide any evidence or documentation supporting their trading strategies, algorithms, performance history, fees, commissions, or risks. Moreover, the absence of demo accounts and educational resources leaves clients in the dark about what they’re getting into.

Location:

The mystery deepens when it comes to BitSoft360 and BitSoftAI360’s physical location. The platforms choose to remain faceless, offering only an email address and phone number, both of which lack reliability and verifiability. With no terms and conditions, privacy policy, or disclaimer pages on their website, the platforms seem to revel in their lack of transparency. This secrecy raises questions about their identity and location, suggesting they may be trying to evade legal consequences.

Customer Service:

The dismal customer service provided by BitSoft360 and BitSoftAI360 adds another layer of concern. With no live chat or support ticket options, communication is limited to email and phone, both of which are often unresponsive. Numerous customer complaints detail difficulties in reaching platform representatives, and some even allege mistreatment and pressure tactics to extract more deposits or sensitive information.

Conclusion:

In conclusion, the cautionary tale of BitSoft360 and BitSoftAI360 unfolds as a classic online scam in the making. The lack of regulation, negative reviews, dubious claims, undisclosed locations, and abysmal customer service all point to a venture that should be approached with extreme caution. To safeguard your investments, it is advisable to steer clear of these platforms and report them to relevant authorities if you happen to cross paths with their enticing but deceptive offerings.